Insurance in the Modern Era: A Breakdown of the Tech That’s Actually Worth Your Investment

The rundown

- Investing in innovative tech will help you remain ahead of the competition and retain customers in a time when low insurance rates trump loyalty

- Streamline repetitive tasks and interview 20% more candidates with remote interviewing software

- 63% of insurers have done formal planning and analysis to prepare for a cloud migration

- Insurers using RPA can process claims up to 75% faster and cut form registration processes by 60%

- Blockchain can drastically improve your cybersecurity – but beware of making the commitment without the current infrastructure in place

Table of contents

- The current insurance landscape

- Win the war for talent

- Improve data tracking and analysis

- Boost productivity and retention

- Speed up processes and strengthen security

- Kick your outdated tech to the curb

- About interviewstream

The current insurance landscape

Despite the U.S. economy flipping on its head earlier this year, the insurance industry has remained strong, with many insurers maintaining profitability and even growing. Instead of financial instability though, the industry continues to grapple with the same glaring issue it has for years now — the high rate of retirees leaving the workforce without younger talent to take the reins.

Now is the opportune time for insurers to capitalize on the drastic changes happening in the marketplace to rebrand and attract Millennial and Gen Z workers. But, how?

Proactively bringing more tech into the fold is a great place to start. Investing in innovative tech is about more than just recruiting younger talent (although it’ll definitely help) — it’ll also allow you to remain a step ahead of the competition and retain your customer base in a day and age when low rates trump loyalty.

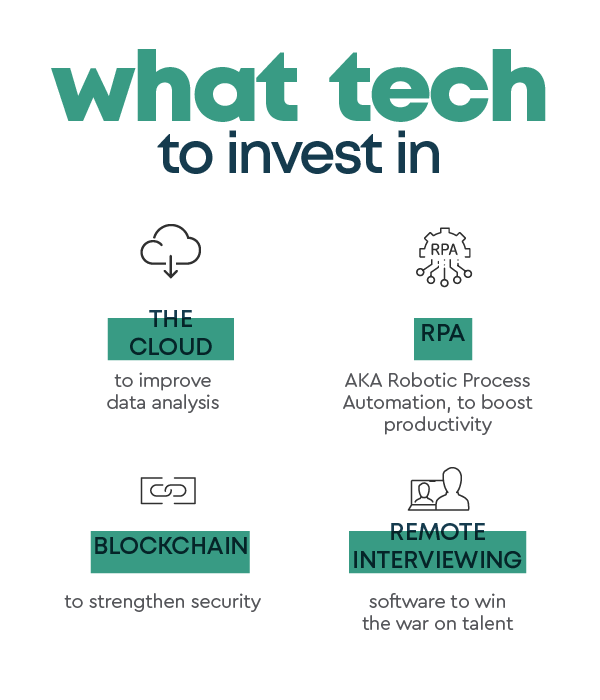

We took a look at the insurance tech that’s making headlines right now to help you decide: what’s worth the investment for you?

If you want to win the war for talent: remote interviewing software

At a time when insurers are struggling to convey why insurance is an appealing industry to start a career, remote interviewing software is a no-brainer.

On the surface, video interviews seem as straightforward as a FaceTime convo, but there’s so much more to hiring than just the interview and an interview isn’t just a friendly conversation with your best friend.

Software, like interviewstream, automates scheduling; stores recordings and notes; and streamlines repetitive tasks so hiring managers and recruiters can focus on the big stuff (while retaining brand consistency).

With remote interviewing software, companies have seen a 20% increase in top candidates interviewed and an 80% decrease in time spent on each interview. Plus, 81% of candidates find digital interview platforms innovative.

Source: “Infographic: How Tech is Bringing the Insurance Sector Into the Modern Era“

If you want to improve data tracking & analysis: cloud migration

The challenge of consolidating data in one place is far from new, and as more insurers experience this growing pain, they’re opting to migrate from platforms to the cloud. The amount of information being collected on a daily basis is just too large for companies to manually work through.

Transformation to the cloud is a long-term commitment, but the benefits are obvious to the majority of the insurance industry — 63% of insurers have done formal planning and analysis to prepare for their impending migration.

Interested in our HR newsletter? Sign up below!

Sign up for our newsletter – we send out a newsletter email two to four times a year which includes HR trends, industry-relevant knowledge, and the latest interviewing tips for recruiters and candidates.

If you want to boost productivity and retention: robotic process automation (RPA)

The term “artificial intelligence” tends to evoke a response, whether that be excitement or fear (probably both if we’re being honest). Luckily, at least for the insurance industry, we’re not referring to the “Arnold Schwarzenegger circa Terminator” kind of AI — RPA is a bit more simple than that.

The tech can be used to automate transactions, process claims, verify documents, and offer customers more options for self-service, alleviating those tasks from your agents.

With RPA, claims can be processed up to 75% faster and the time it takes to complete the form registration process can be cut by 60%. Basically, the machines take care of the mindless repetitive work, enhancing the quality of human jobs (and boosting your retention rate).

If you want to speed up processes & strengthen security: blockchain

Another buzzword that sparks a visceral response is blockchain. The confusing nature of the tech is intimidating, but if you recall, just a few years ago the entire insurance industry took a $375 million hit when Anthem Insurance revealed a data breach impacting nearly 80 million customers.

Blockchain is the first (and strongest) line of defense to prevent future attacks. In short, the tech strengthens cybersecurity, improves fraud prevention, and augments processes so you can more effectively serve your clients.

“Tomorrow’s market leaders will be technology-enabled, data-driven, and operationally efficient, but also people-powered and purpose-led”

– EY 2020 Insurance Outlook

On the flip side, we can’t recommend just jumping on the blockchain bandwagon — it’s better to adopt blockchain once you have the rest of your tech infrastructure operating smoothly. That’s because the speed and efficiency of blockchain is dramatically changing consumer service expectations, raising them even higher. Be cautious when considering a blockchain investment so you don’t accidentally end up biting off more than you can chew.

Kick your outdated tech to the curb

To maximize lifetime customer value, you have to invest in the up-and-coming technology that will take your operations to the next level. Kick your outdated legacy system to the curb and provide your agents the tools that they need to succeed today.

With upgraded tech, they’ll perform at a higher level which will strengthen your consumer relationships and attract more dedicated workers (not to mention, boost your bottom line).

About interviewstream

interviewstream is an industry leading recruiting software company that helps you reach your top candidates more effectively. Our customers have completed over 3 million interviews using interview builder, interview on demand, interview scheduler, interview connect – and we’d love to help you as well. Talk to an expert today to learn how to get started.

Want a PDF version of this eBook?

Fill out the form below to get a PDF version of this eBook.

The interviewstream platform

Speak to an expert today to learn how our remote interviewing solutions make hiring more effective.

About interviewstream

As companies transition to remote work, we exists to help recruiters and hiring teams ask the right questions every time, screen candidates faster, make scheduling easier and reach candidates everywhere. Using our remote interviewing platform, your team will have a complete view of the candidate in one location while also leveraging one of the leading platforms for online interviewing.